Reuters Financials Data Guide

The Reuters Financials dataset available through Interactive Brokers provides cash flow, balance sheet, and income metrics. Data are time-indexed to the relevant fiscal period as well as the filing date for point-in-time backtesting.

Financials at-a-glance

| Number of indicators | approx. 125 |

| Period types | Annual or Interim |

| Annual reports available | 6 years |

| Quarterly reports available | 6 quarters |

| Includes filing date (point in time) | yes |

| Includes restatements | yes |

Depth of coverage

The Reuters Financials dataset does not provide data back to a fixed start date but rather provides a rolling window of historical data from the time the data is collected. The typical amount of data available is 6 years of annual statements and 6 quarters of interim statements.

Available indicators

Balance sheet

AACR: Accounts Receivable - Trade, Net

ACAE: Cash & Equivalents

ACDB: Cash & Due from Banks

ACSH: Cash

ADEP: Accumulated Depreciation, Total

ADPA: Deferred Policy Acquisition Costs

AGWI: Goodwill, Net

AINT: Intangibles, Net

AITL: Total Inventory

ALTR: Note Receivable - Long Term

ANTL: Net Loans

APPN: Property/Plant/Equipment, Total - Net

APPY: Prepaid Expenses

APRE: Insurance Receivables

APTC: Property/Plant/Equipment, Total - Gross

ASTI: Short Term Investments

ATCA: Total Current Assets

ATOT: Total Assets

ATRC: Total Receivables, Net

LAEX: Accrued Expenses

LAPB: Accounts Payable

LCLD: Current Port. of LT Debt/Capital Leases

LCLO: Capital Lease Obligations

LDBT: Total Deposits

LLTD: Long Term Debt

LMIN: Minority Interest

LPBA: Payable/Accrued

LSTB: Total Short Term Borrowings

LSTD: Notes Payable/Short Term Debt

LTCL: Total Current Liabilities

LTLL: Total Liabilities

LTTD: Total Long Term Debt

QEDG: ESOP Debt Guarantee

QPIC: Additional Paid-In Capital

QRED: Retained Earnings (Accumulated Deficit)

QTCO: Total Common Shares Outstanding

QTEL: Total Liabilities & Shareholders' Equity

QTLE: Total Equity

QTPO: Total Preferred Shares Outstanding

QTSC: Treasury Stock - Common

QUGL: Unrealized Gain (Loss)

SBDT: Deferred Income Tax

SCMS: Common Stock, Total

SCSI: Cash and Short Term Investments

SINV: Long Term Investments

SLTL: Other Liabilities, Total

SOAT: Other Assets, Total

SOBL: Other Bearing Liabilities, Total

SOCA: Other Current Assets, Total

SOCL: Other Current liabilities, Total

SOEA: Other Earning Assets, Total

SOLA: Other Long Term Assets, Total

SOTE: Other Equity, Total

SPOL: Policy Liabilities

SPRS: Preferred Stock - Non Redeemable, Net

SRPR: Redeemable Preferred Stock, Total

STBP: Tangible Book Value per Share, Common Eq

STLD: Total Debt

SUPN: Total Utility Plant, NetIncome statement

CEIA: Equity In Affiliates

CGAP: U.S. GAAP Adjustment

CIAC: Income Available to Com Excl ExtraOrd

CMIN: Minority Interest

DDPS1: DPS - Common Stock Primary Issue

EDOE: Operations & Maintenance

EFEX: Fuel Expense

EIBT: Net Income Before Taxes

ELLP: Loan Loss Provision

ENII: Net Interest Income

EPAC: Amortization of Policy Acquisition Costs

ERAD: Research & Development

ETOE: Total Operating Expense

NAFC: Allowance for Funds Used During Const.

NGLA: Gain (Loss) on Sale of Assets

NIBX: Net Income Before Extra. Items

NINC: Net Income

RNII: Net Investment Income

RRGL: Realized & Unrealized Gains (Losses)

RTLR: Total Revenue

SANI: Total Adjustments to Net Income

SCOR: Cost of Revenue, Total

SDAJ: Dilution Adjustment

SDBF: Diluted EPS Excluding ExtraOrd Items

SDNI: Diluted Net Income

SDPR: Depreciation/Amortization

SDWS: Diluted Weighted Average Shares

SGRP: Gross Profit

SIAP: Net Interest Inc. After Loan Loss Prov.

SIIB: Interest Income, Bank

SINN: Interest Exp.(Inc.),Net-Operating, Total

SLBA: Losses, Benefits, and Adjustments, Total

SNIE: Non-Interest Expense, Bank

SNII: Non-Interest Income, Bank

SNIN: Interest Inc.(Exp.),Net-Non-Op., Total

SONT: Other, Net

SOOE: Other Operating Expenses, Total

SOPI: Operating Income

SORE: Other Revenue, Total

SPRE: Total Premiums Earned

SREV: Revenue

SSGA: Selling/General/Admin. Expenses, Total

STIE: Total Interest Expense

STXI: Total Extraordinary Items

SUIE: Unusual Expense (Income)

TIAT: Net Income After Taxes

TTAX: Provision for Income Taxes

VDES: Diluted Normalized EPS

XNIC: Income Available to Com Incl ExtraOrdCash Flow statement

FCDP: Total Cash Dividends Paid

FPRD: Issuance (Retirement) of Debt, Net

FPSS: Issuance (Retirement) of Stock, Net

FTLF: Cash from Financing Activities

ITLI: Cash from Investing Activities

OBDT: Deferred Taxes

OCPD: Cash Payments

OCRC: Cash Receipts

ONET: Net Income/Starting Line

OTLO: Cash from Operating Activities

SAMT: Amortization

SCEX: Capital Expenditures

SCIP: Cash Interest Paid

SCTP: Cash Taxes Paid

SDED: Depreciation/Depletion

SFCF: Financing Cash Flow Items

SFEE: Foreign Exchange Effects

SICF: Other Investing Cash Flow Items, Total

SNCC: Net Change in Cash

SNCI: Non-Cash Items

SOCF: Changes in Working CapitalValuation metrics

Valuation metrics such as EPS or P/E ratio compare a company's fundamentals to its share price or market value. These metrics are useful for comparing companies, unlike metrics such as net income which scale with the size of the company and thus aren't typically used for company-to-company comparisons.

The Reuters financial statements dataset is fairly "raw" and does not include any precalculated valuation metrics. You can, however, calculate valuation metrics yourself in conjunction with historical price data. See the usage guide for an example of calculating enterprise multiple.

Point-in-time date fields

The financial statements dataset provides two date fields:

FiscalPeriodEndDate: the end date of the fiscal period the report is forSourceDate: the date the report was released (for U.S. companies, this is usually the Form 10-K filing date)

The SourceDate field can be used for point-in-time analysis.

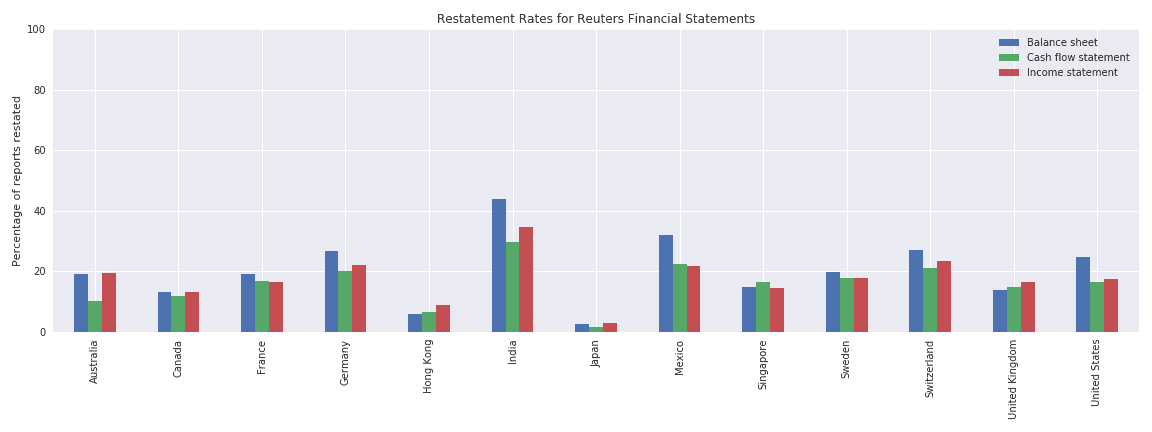

Restatements

Financial statement restatements

The financial statements dataset includes restatements.

Restatements, like the original statements, are time-indexed to their release date via the SourceDate field, so you know when the data became available. Restated data are distinguished from as-reported data, making it possible to exclude restated data from analysis and backtests if you choose.

When restated data is available for a particular fiscal period and financial statement (income statement, balance sheet, or cash flow statement), the corresponding as-reported financial statement is not provided by Reuters. As depicted in the table below, this can create a gap in the data as your research and backtest won't have access to the as-reported financials that would have been available in real time.

| Corporate event | Filing date | Included in Reuters data |

|---|---|---|

| 2014 annual report | February 4, 2015 | yes |

| 2015 annual report | February 3, 2016 | no (overwritten by restatement) |

| 2016 annual report and restatement of 2015 report | February 2, 2017 | yes |

This limitation only applies to financial statements that pre-date your use of QuantRocket. As you continue using QuantRocket to keep your Reuters fundamentals database up-to-date, QuantRocket will preserve the as-reported and restated financials as they appear in real-time, increasing the accuracy of your backtests.

The occurrence rate of restatements is shown below for a variety of countries:

Breadth of coverage

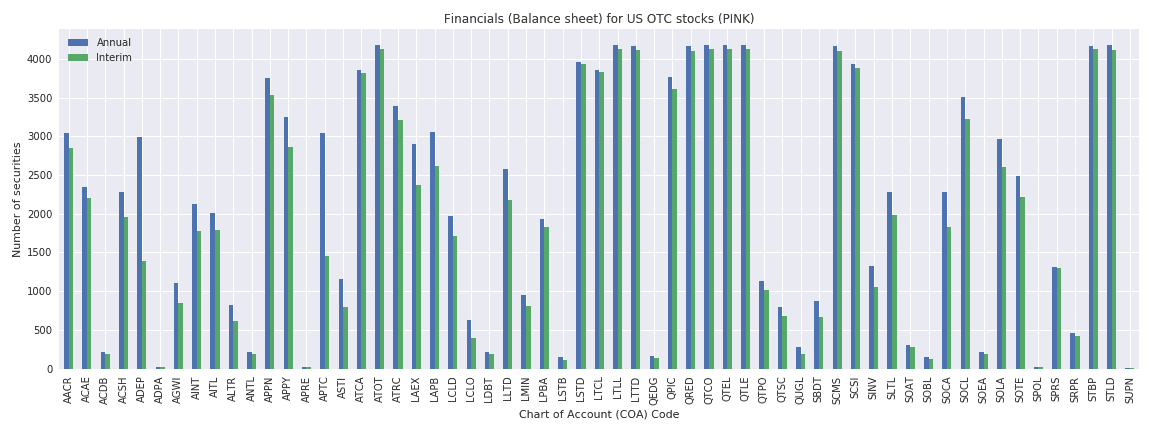

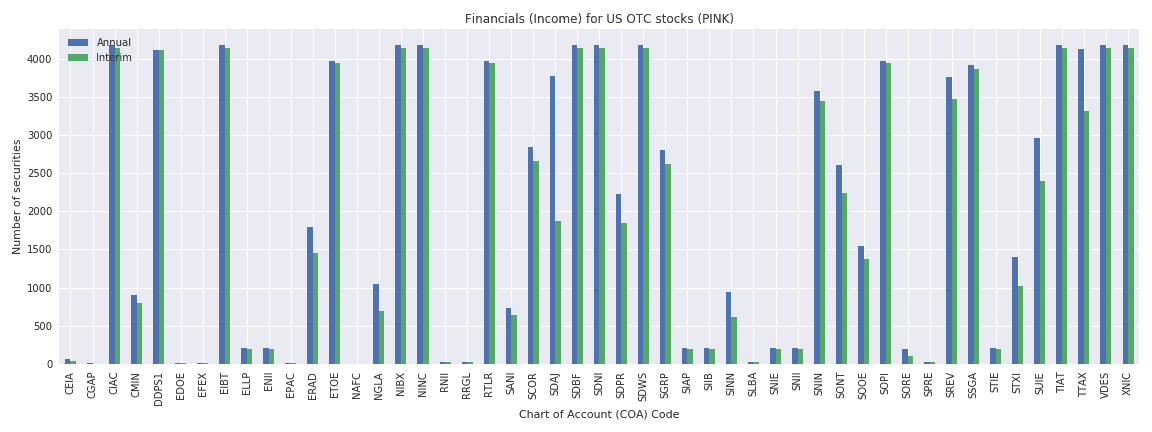

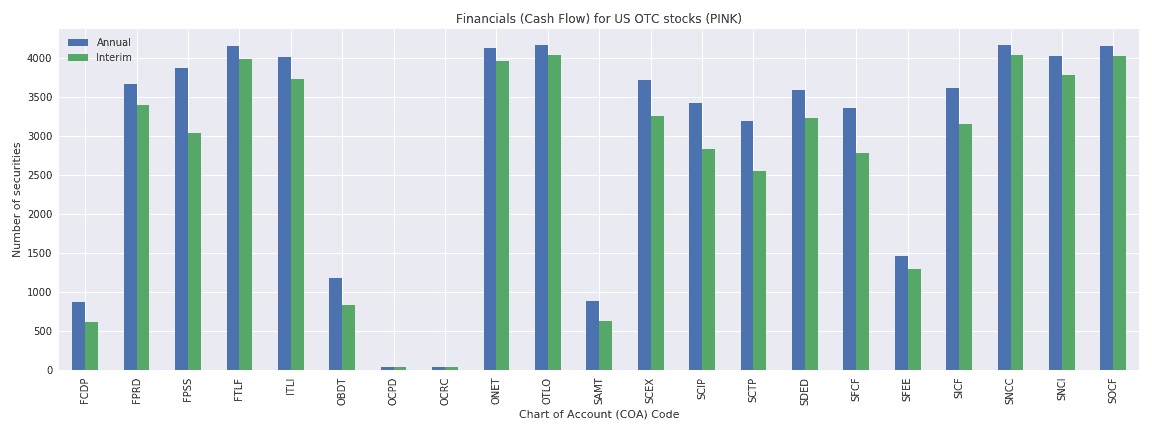

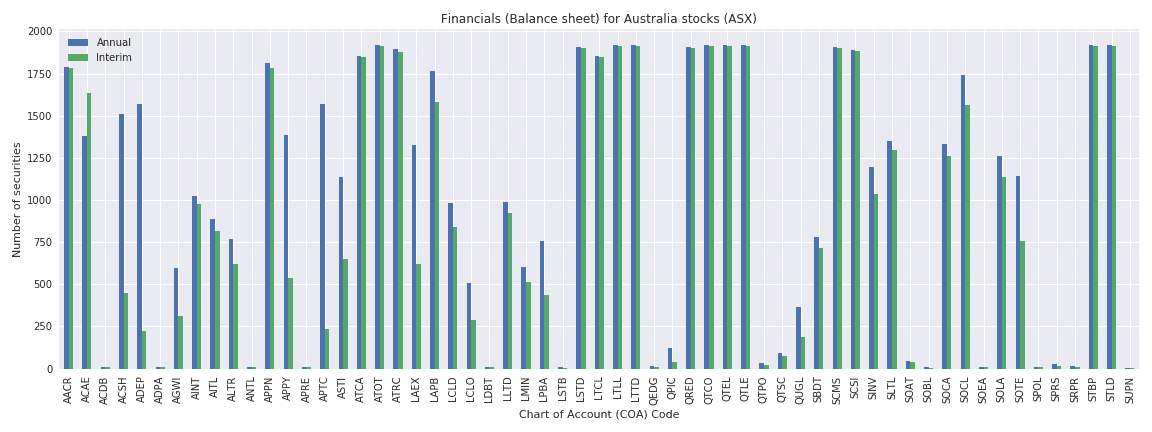

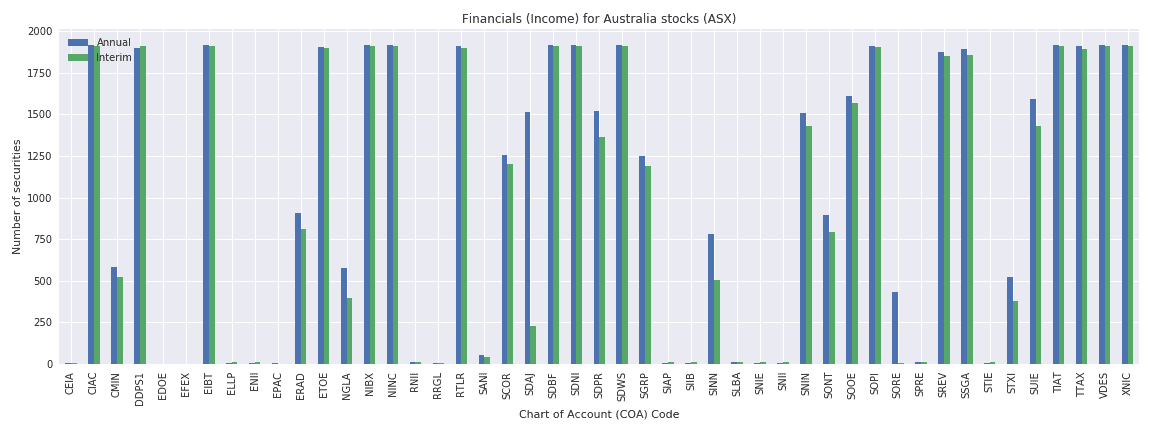

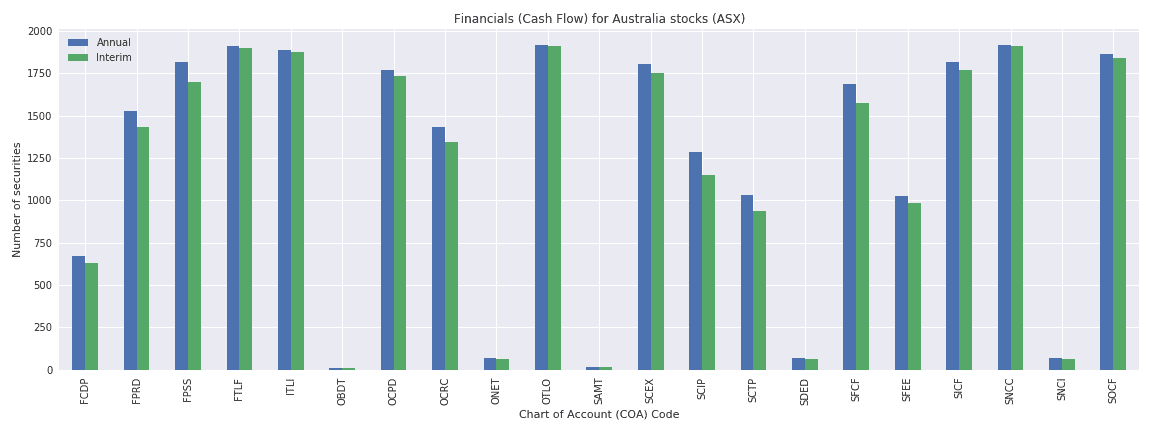

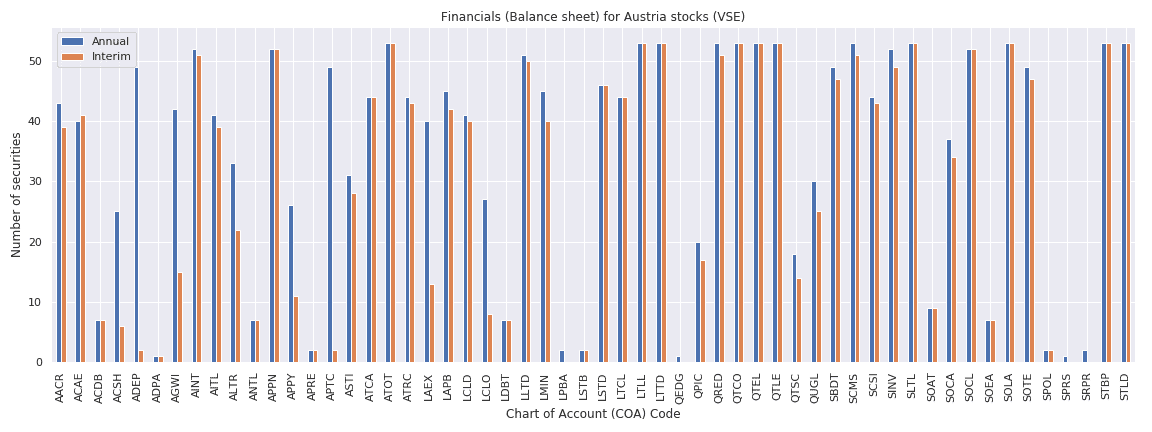

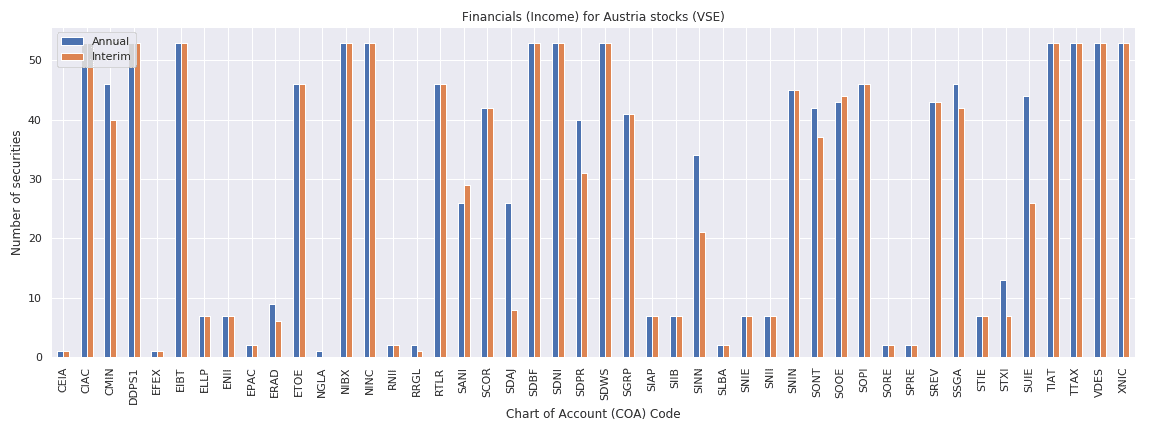

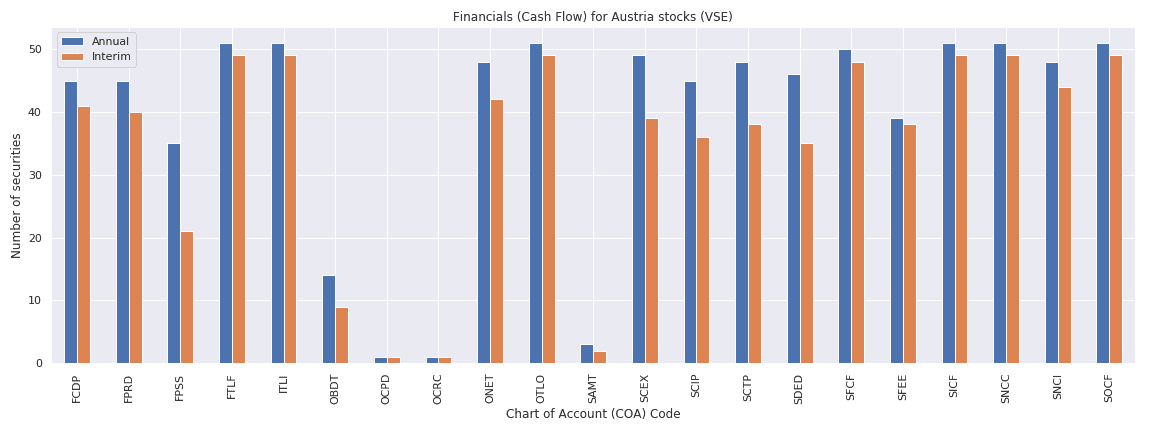

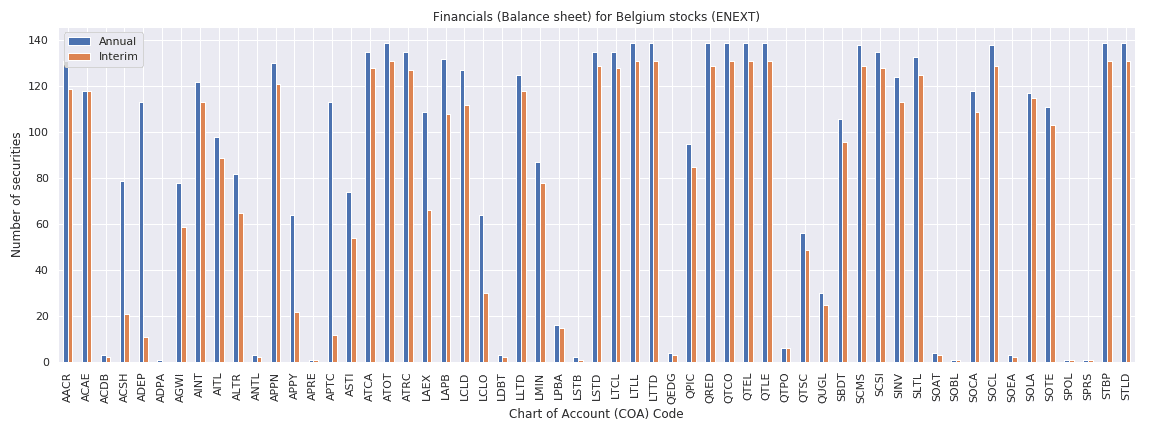

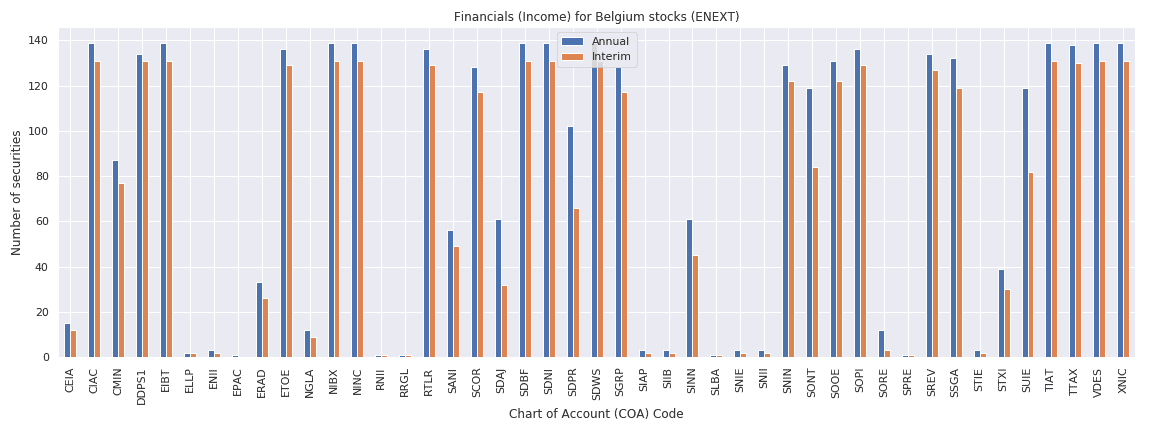

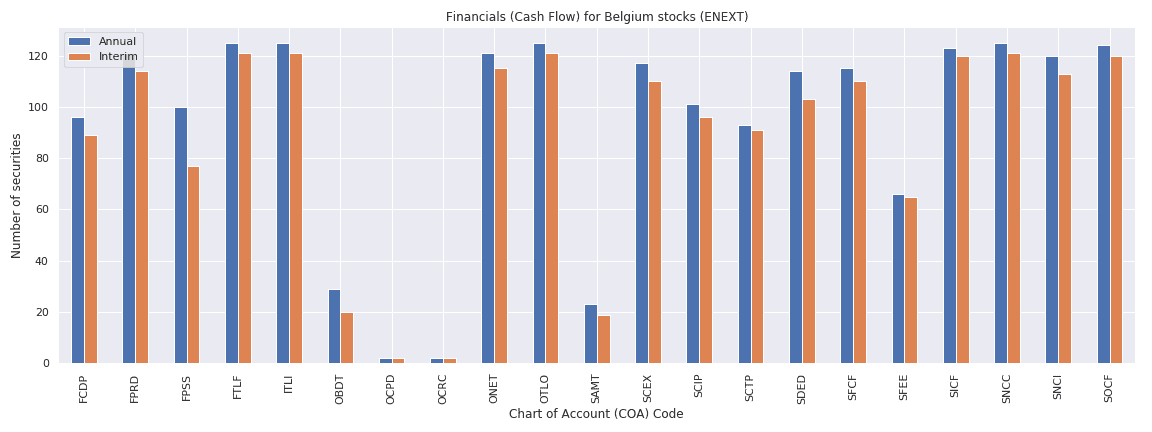

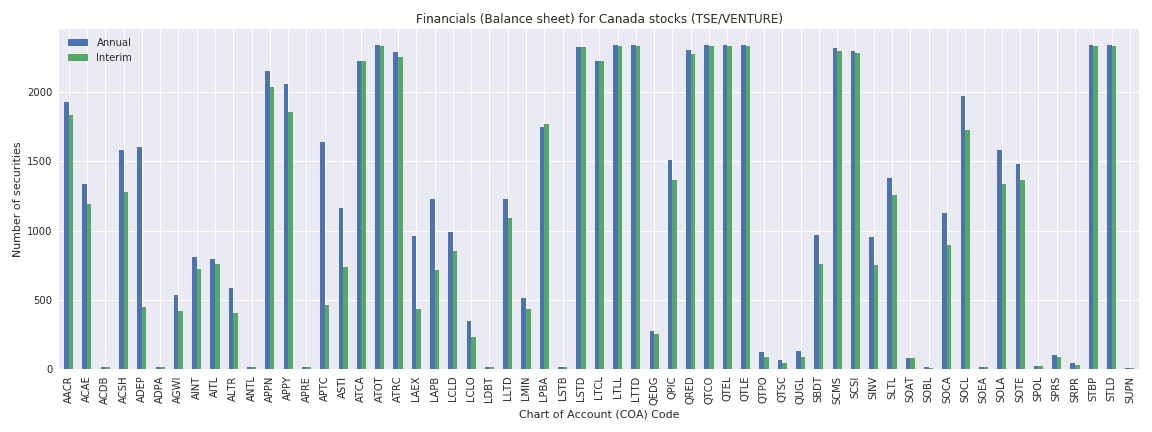

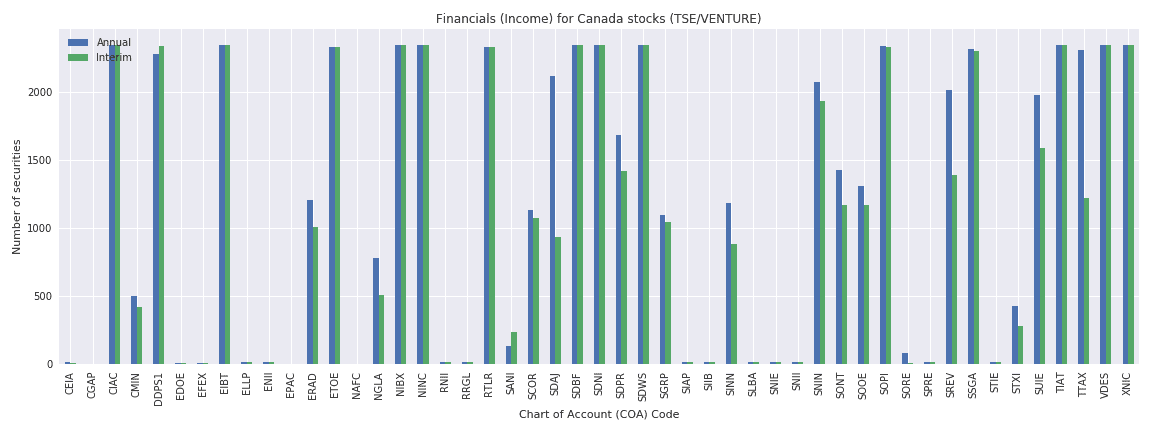

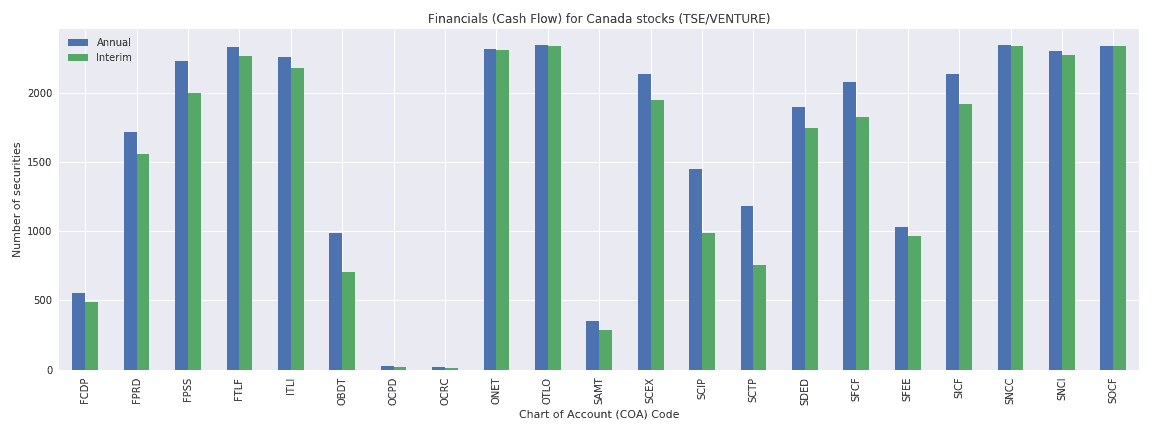

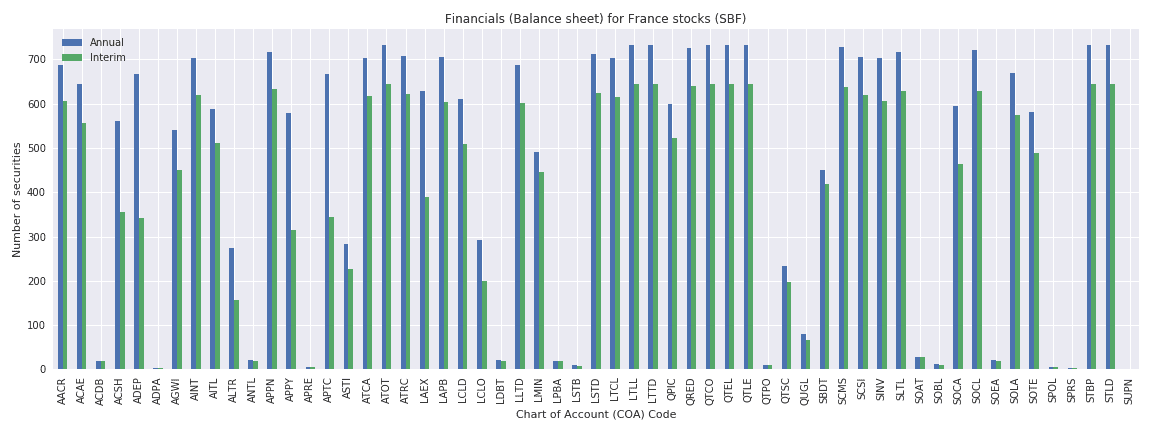

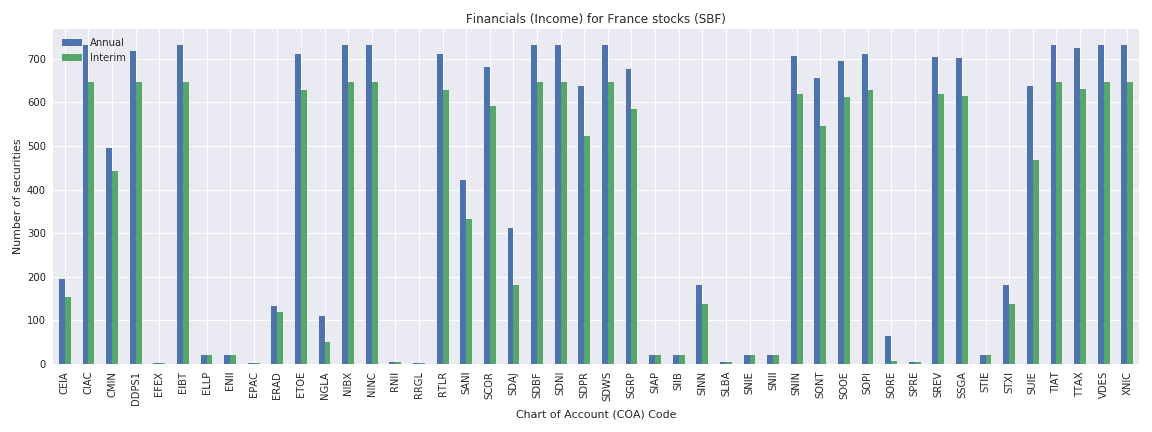

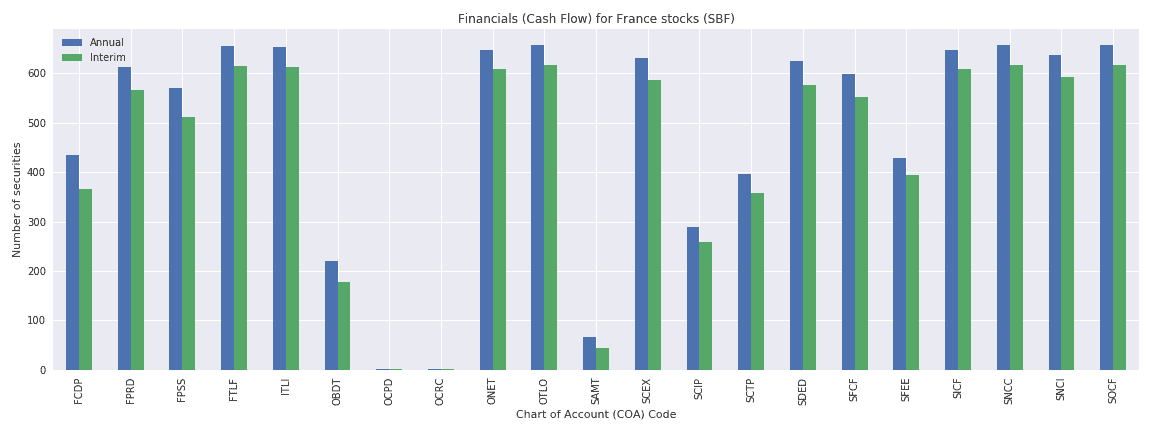

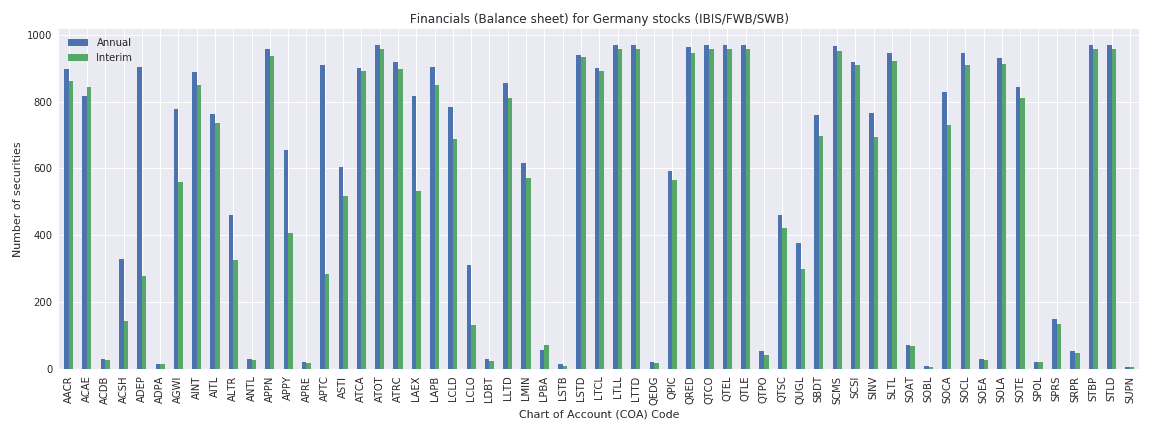

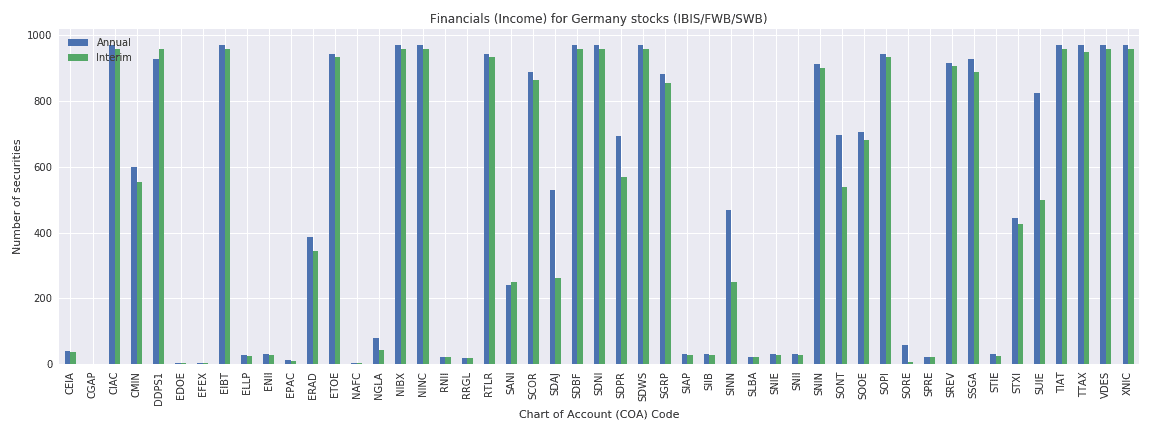

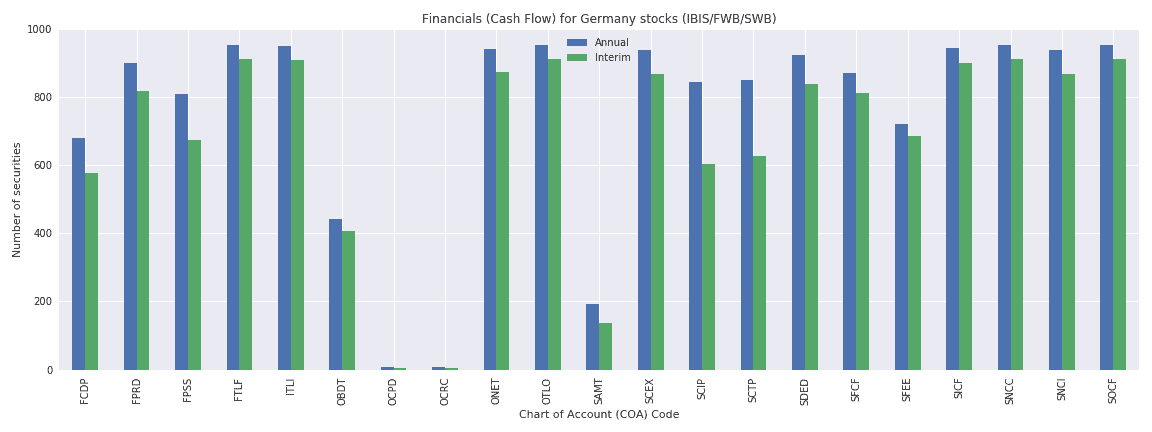

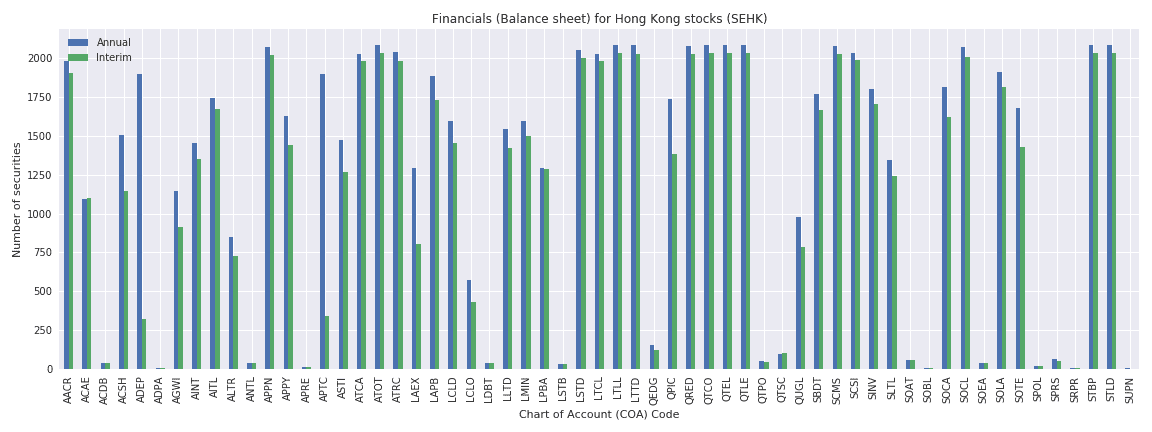

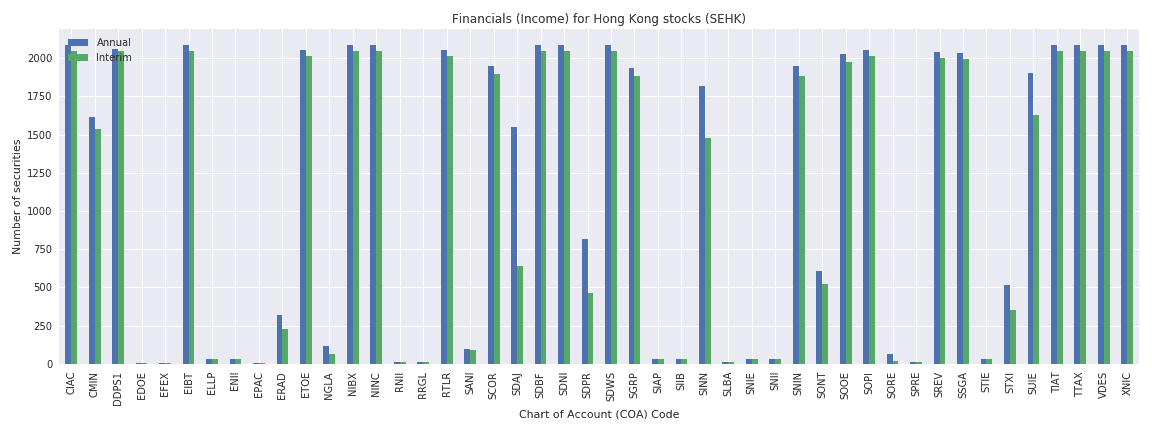

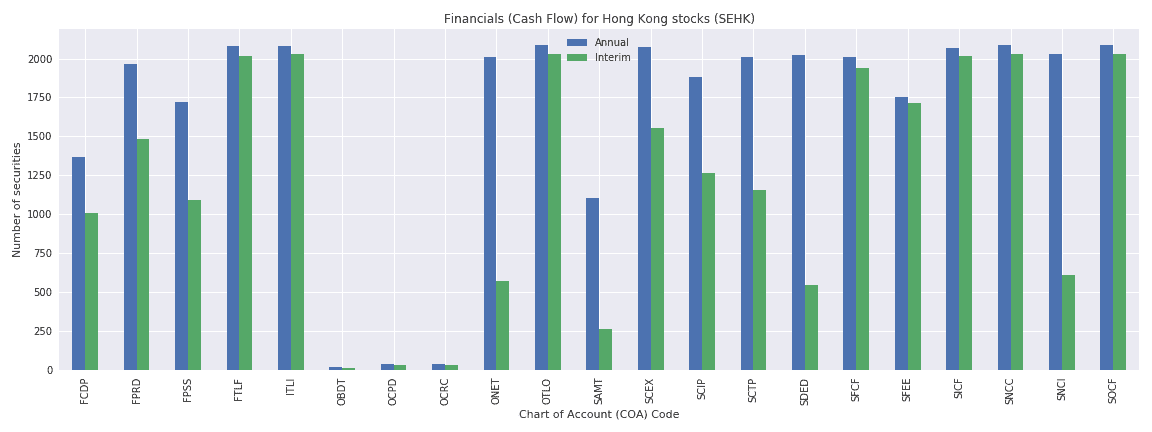

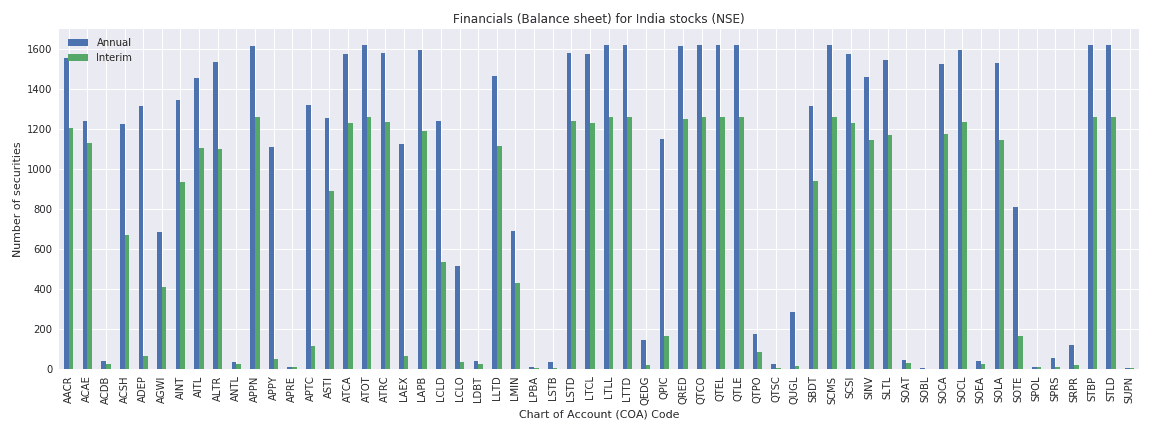

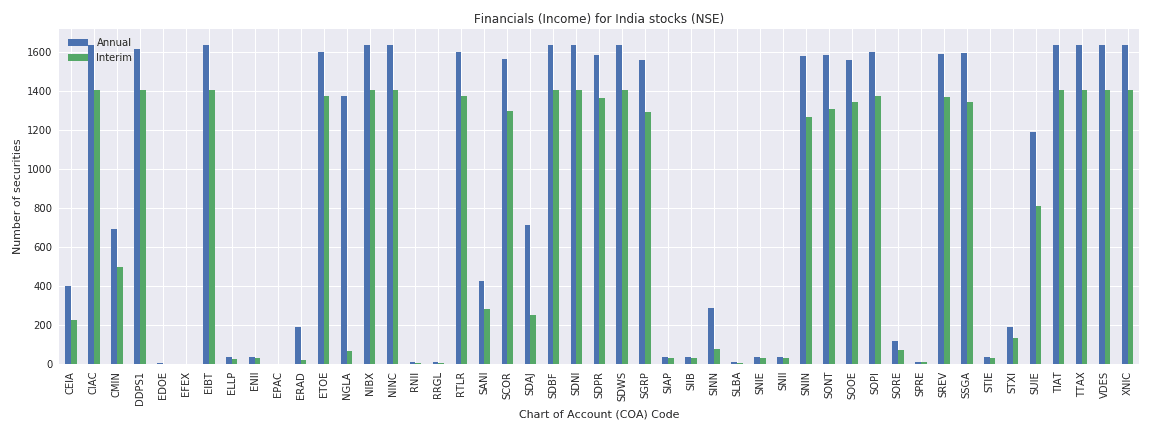

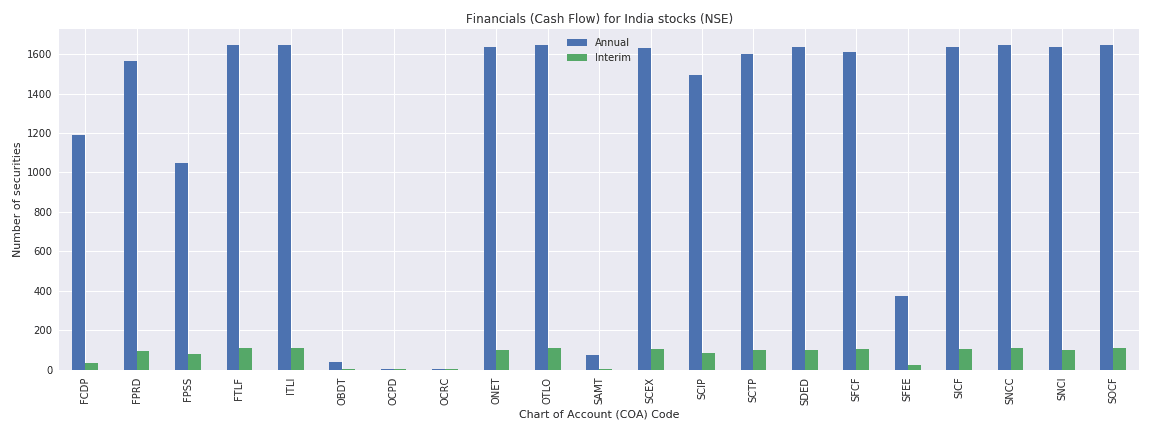

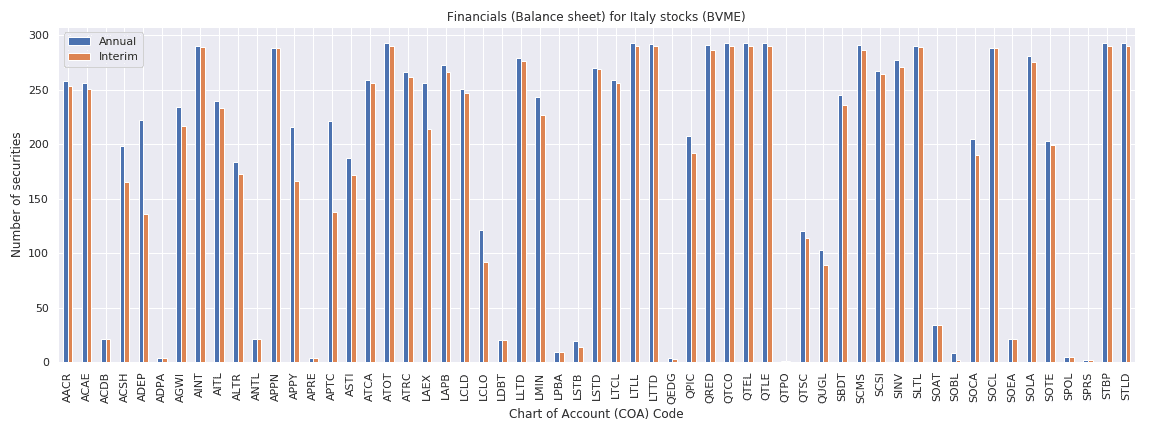

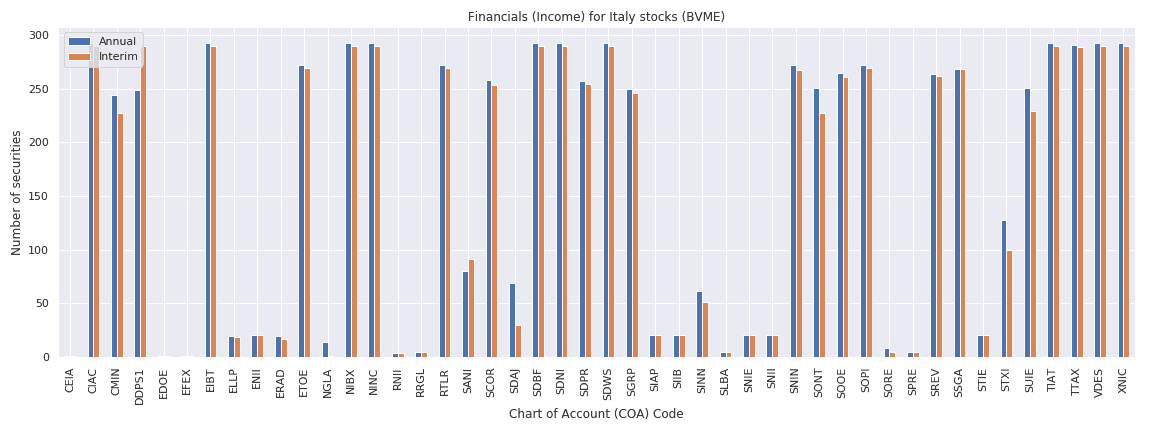

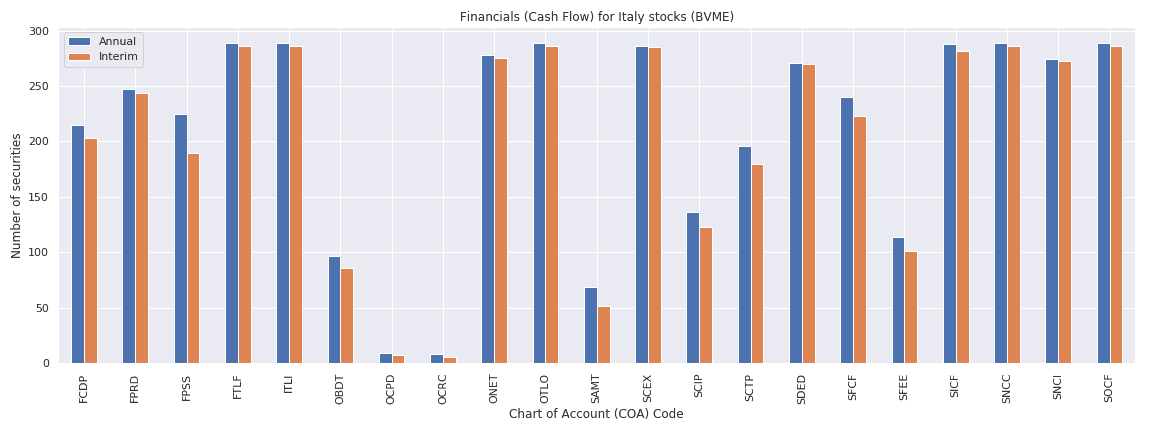

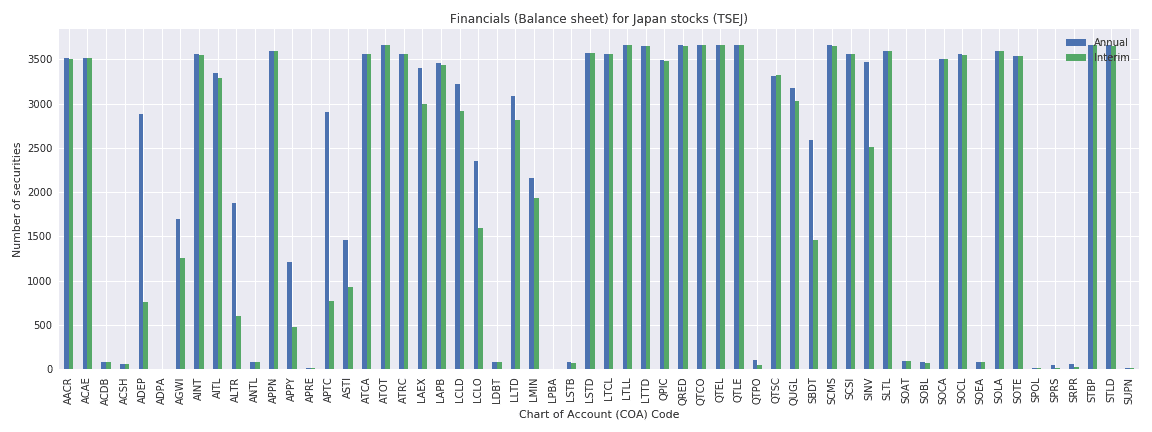

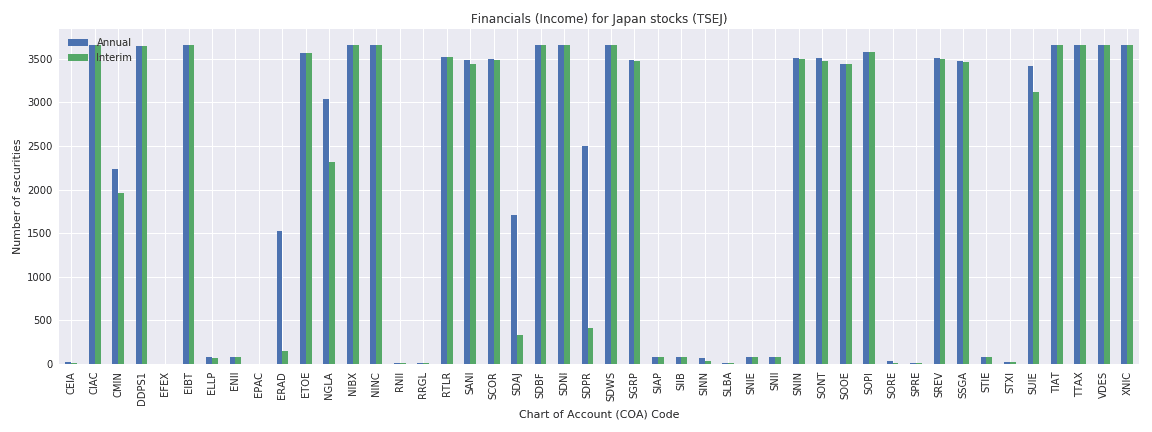

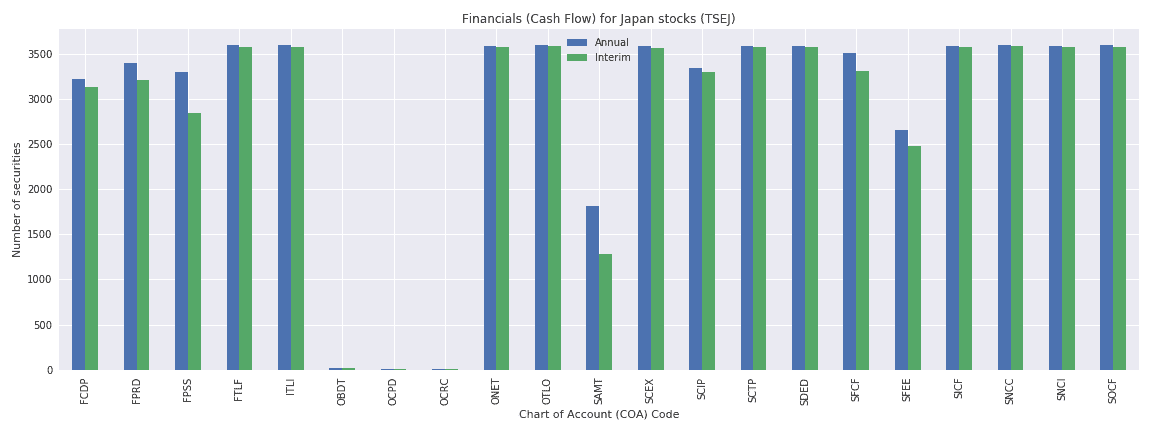

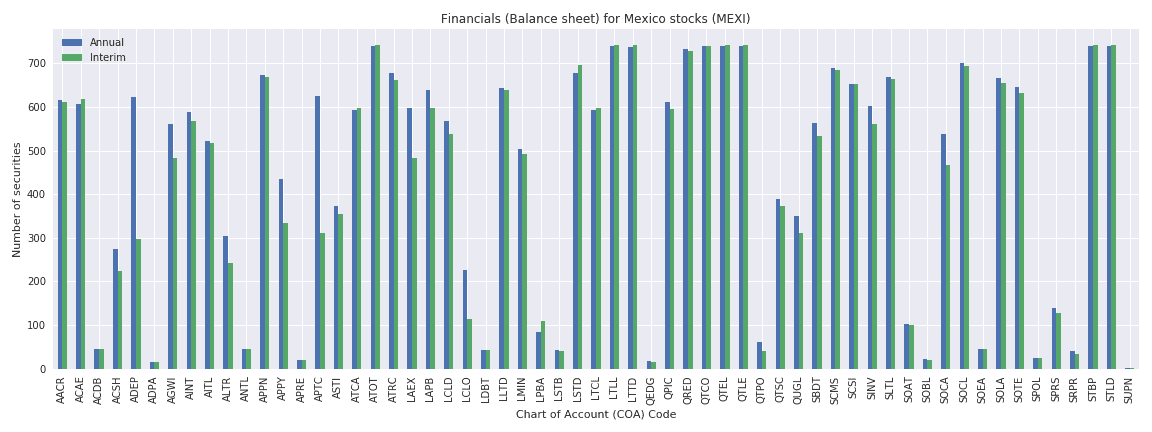

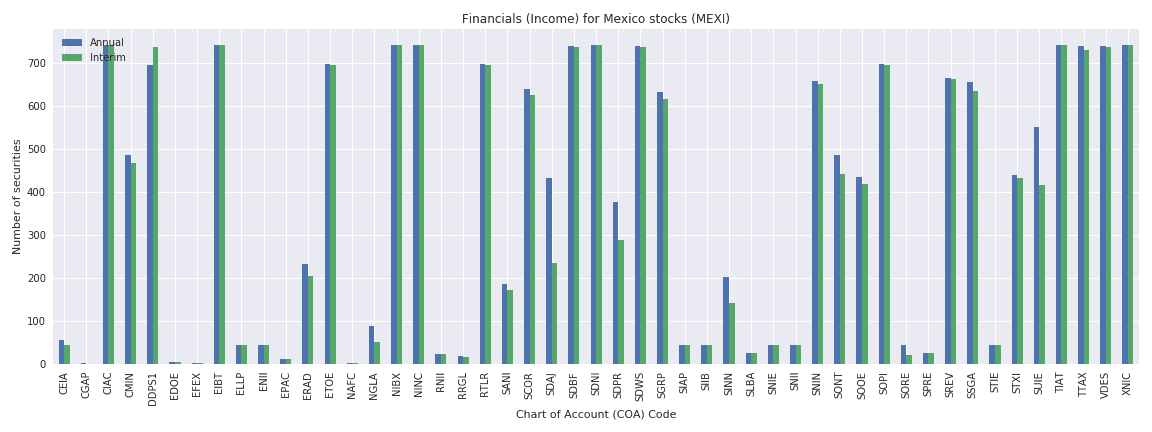

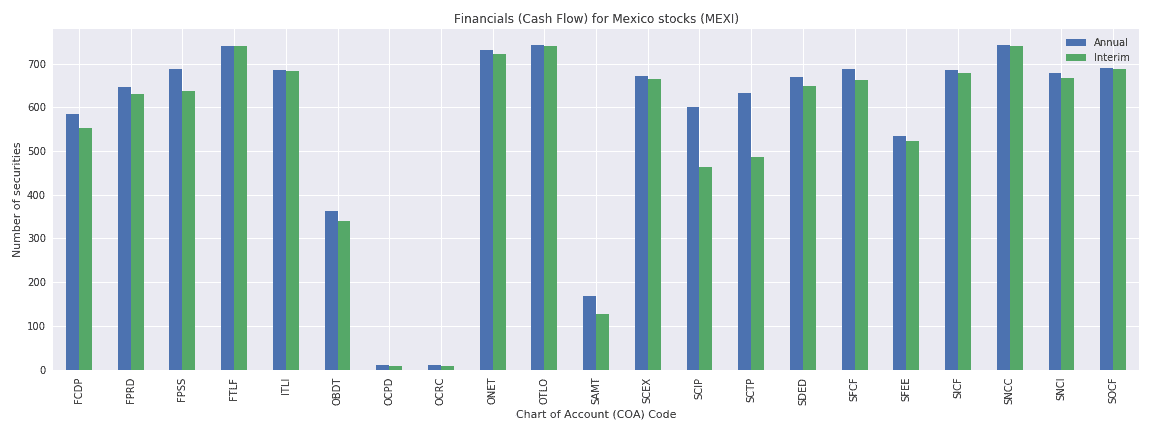

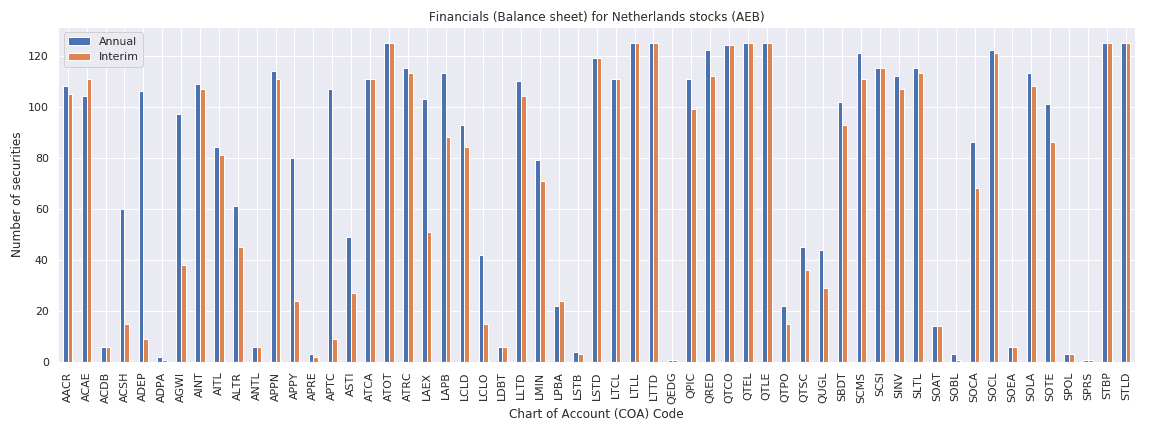

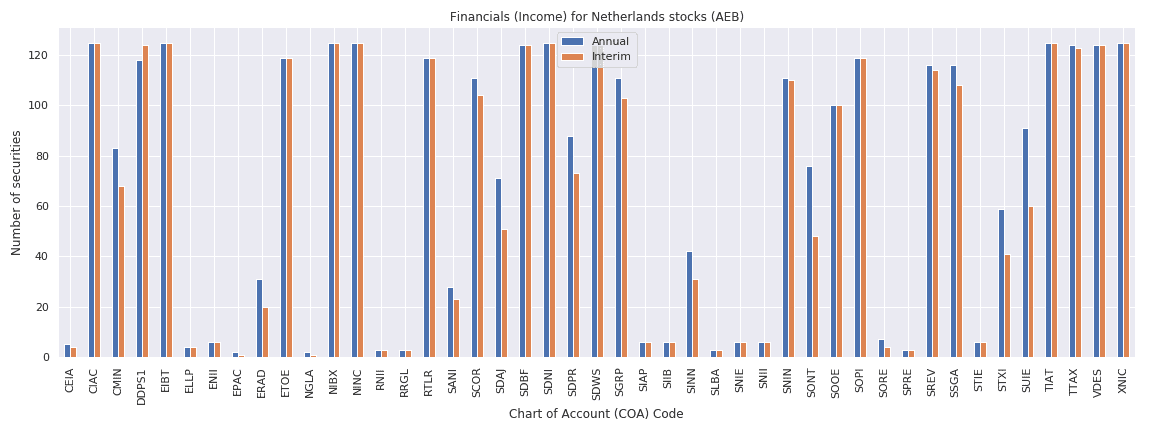

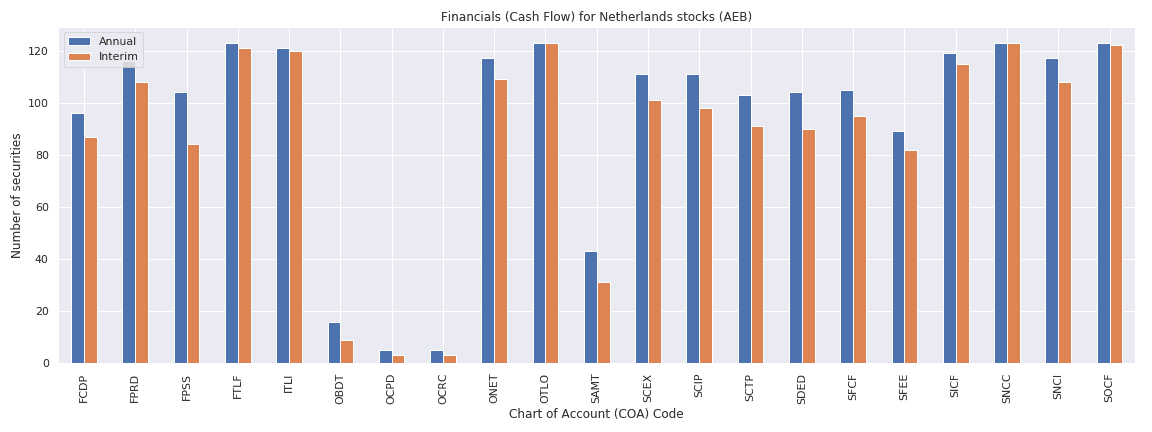

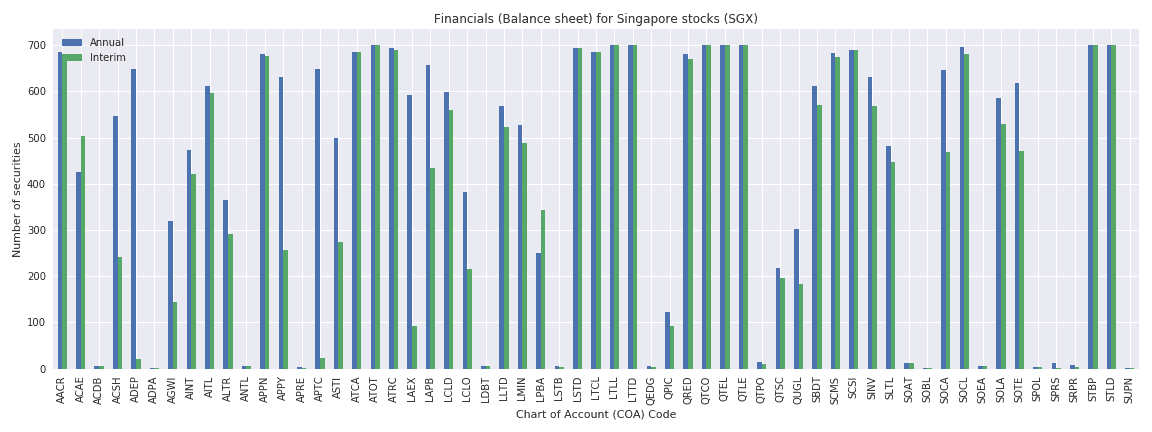

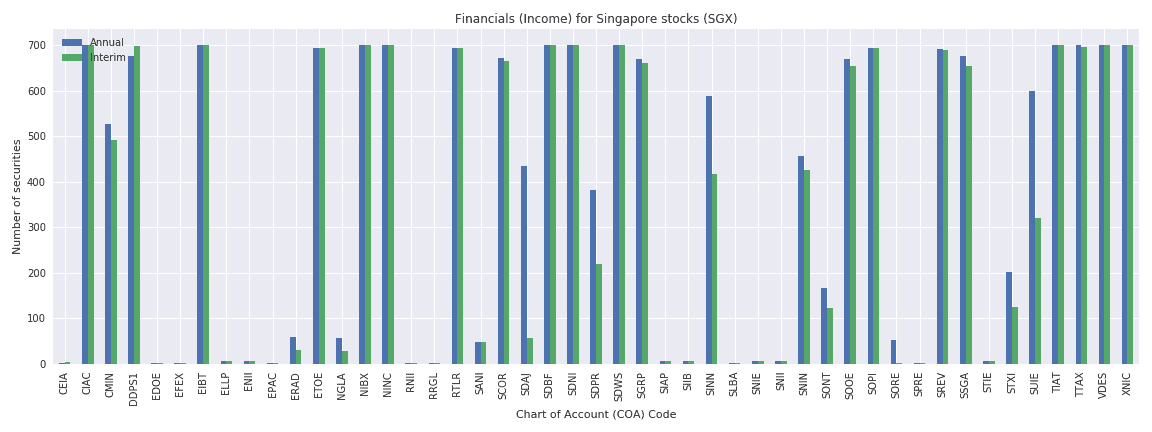

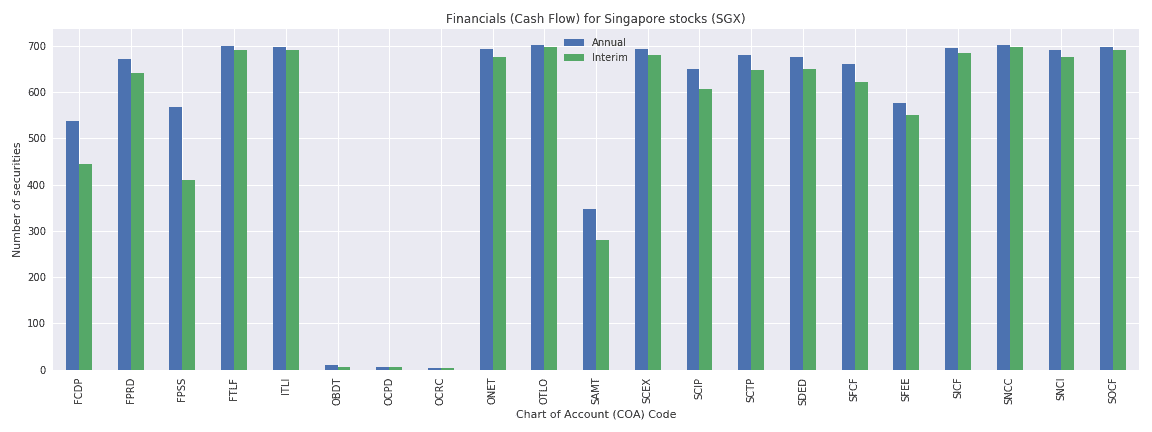

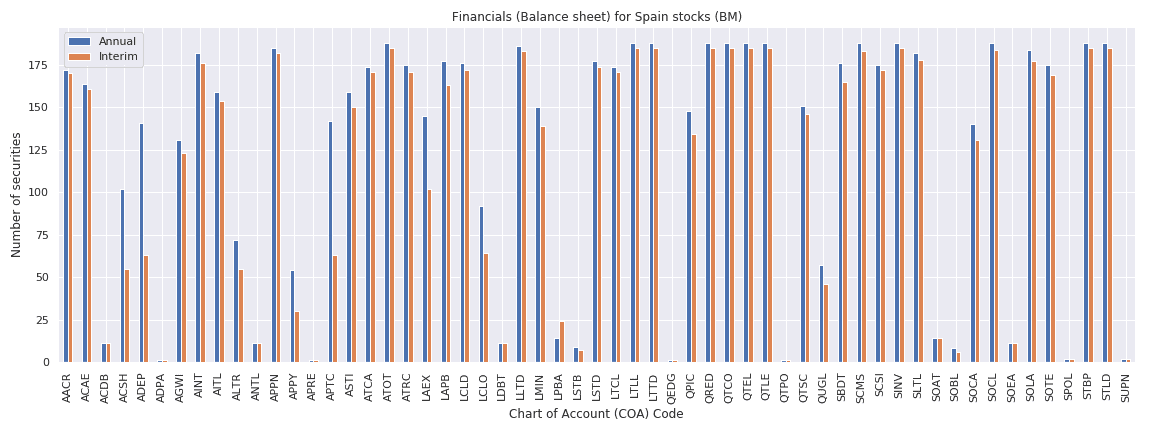

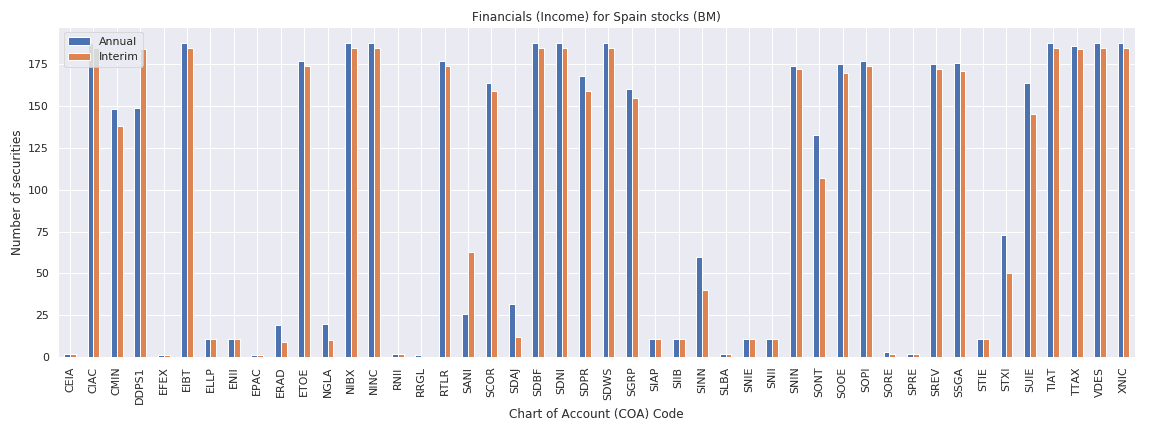

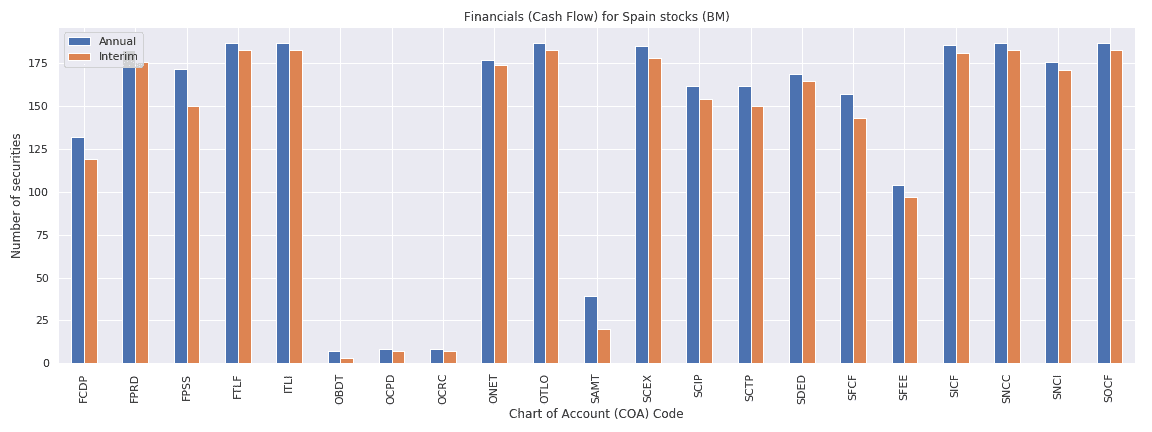

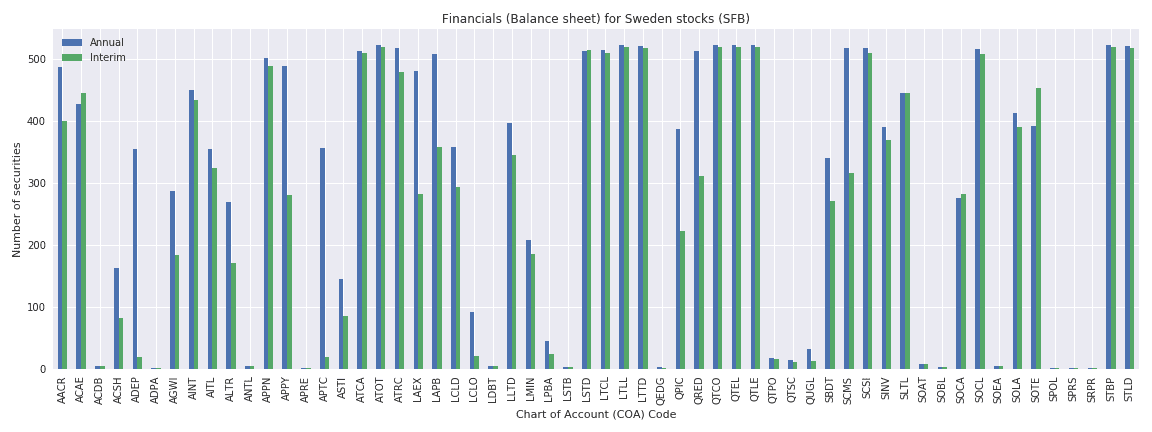

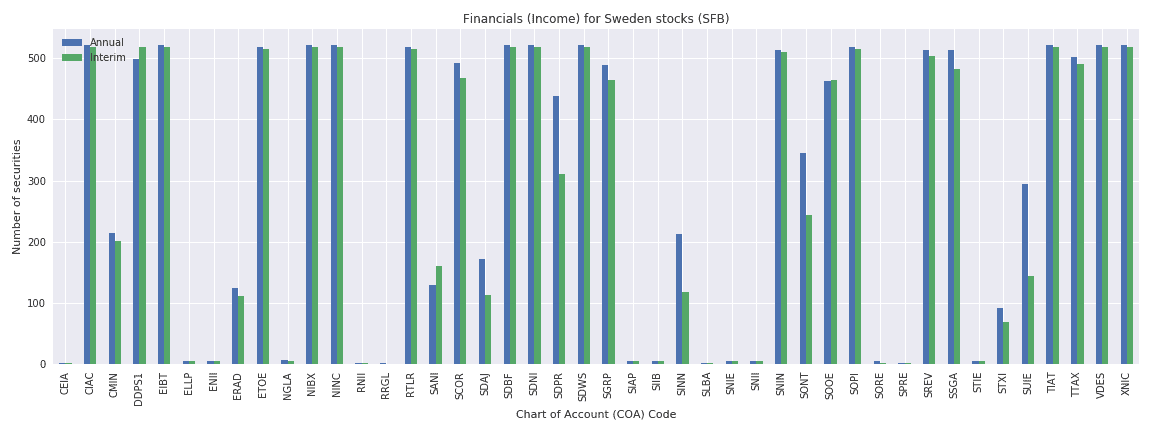

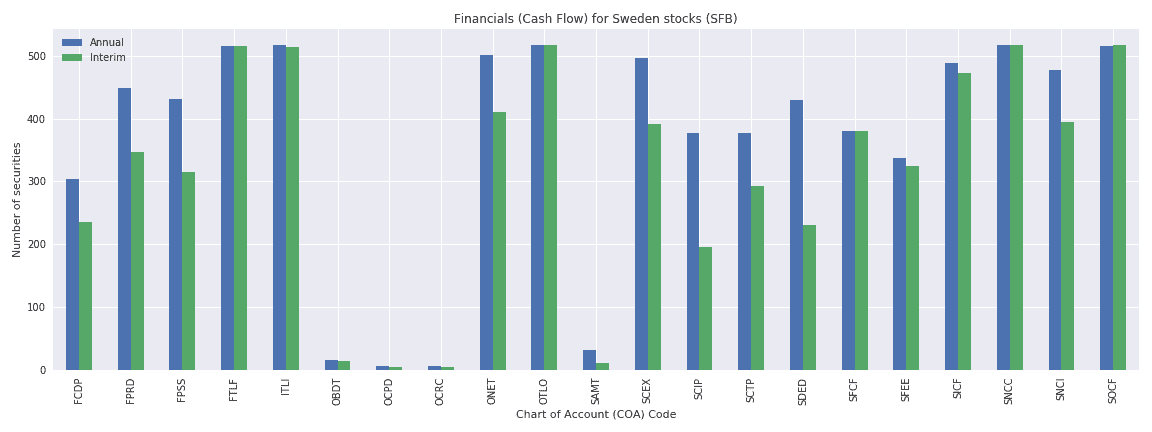

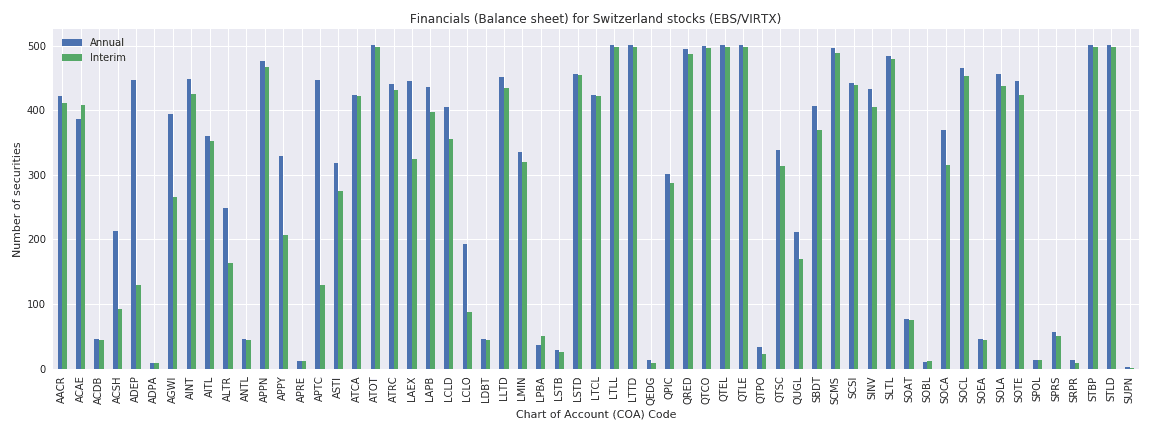

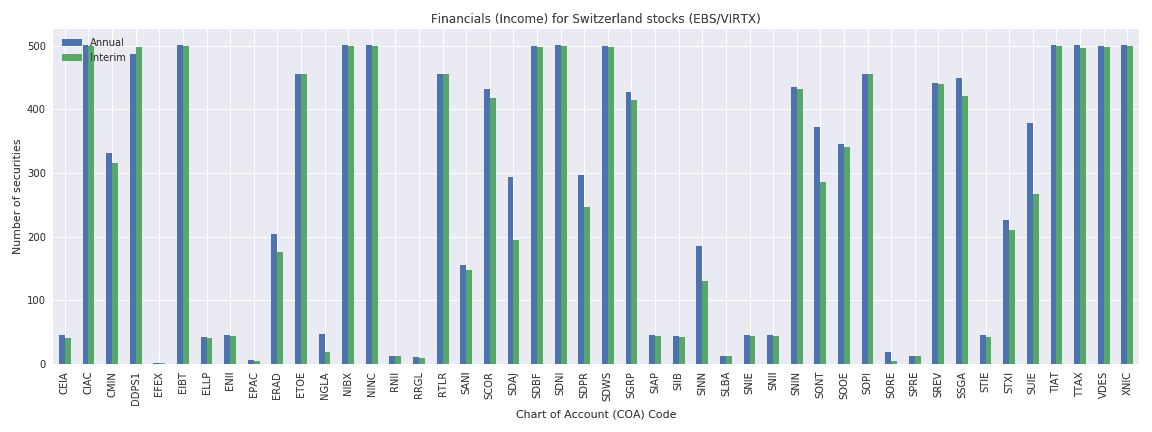

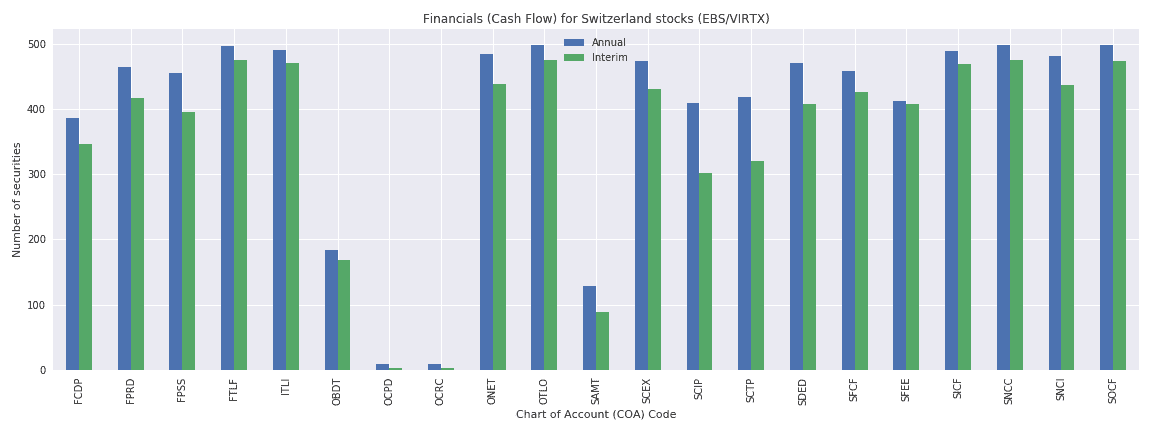

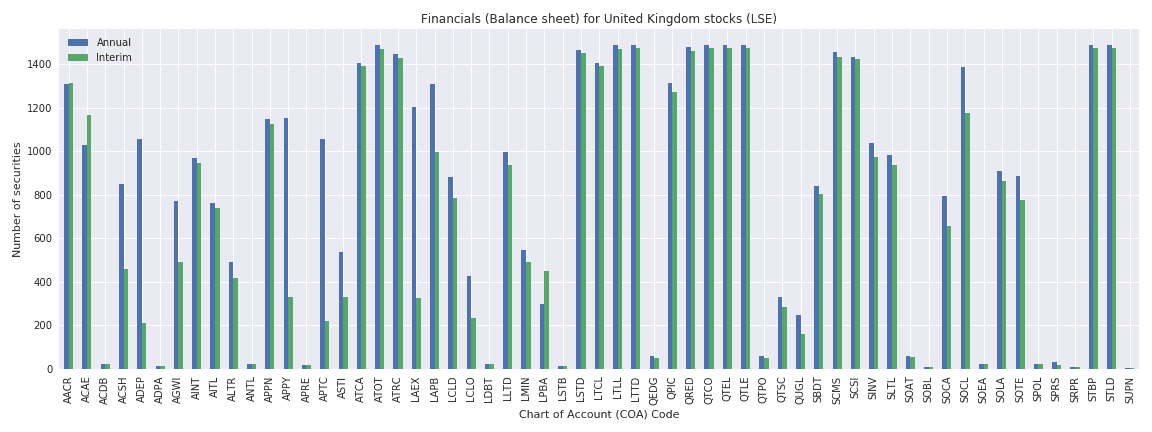

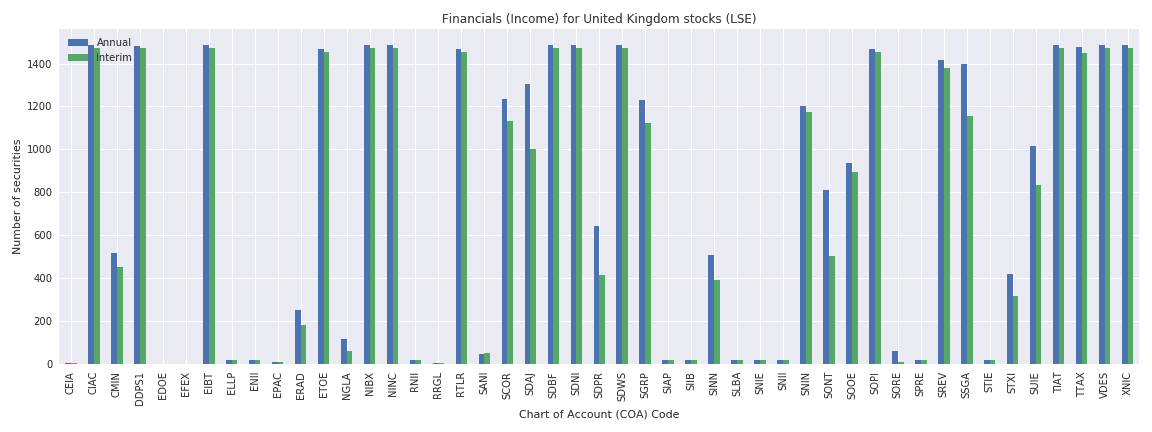

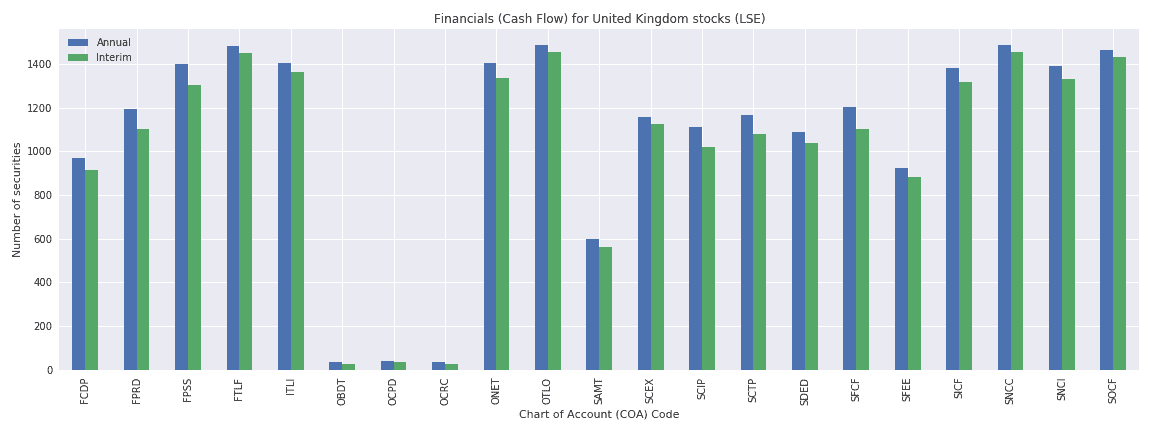

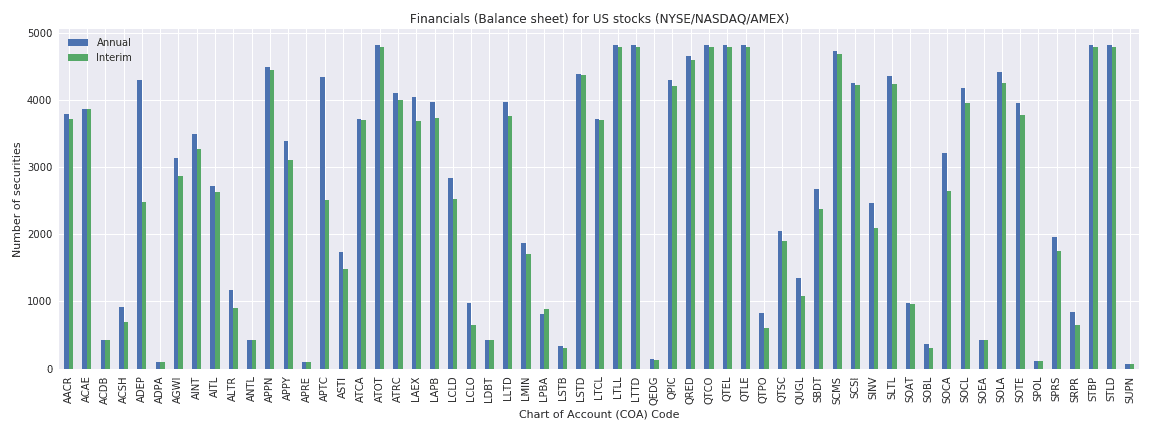

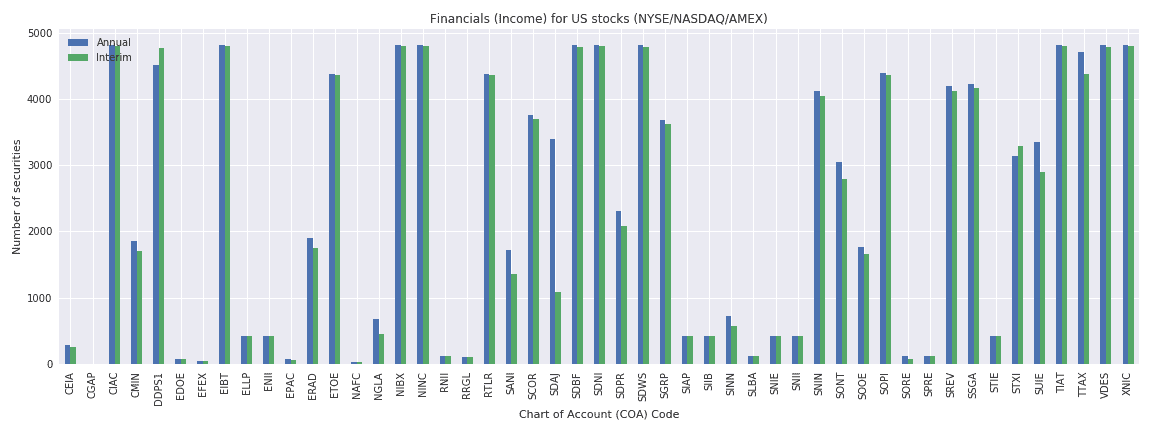

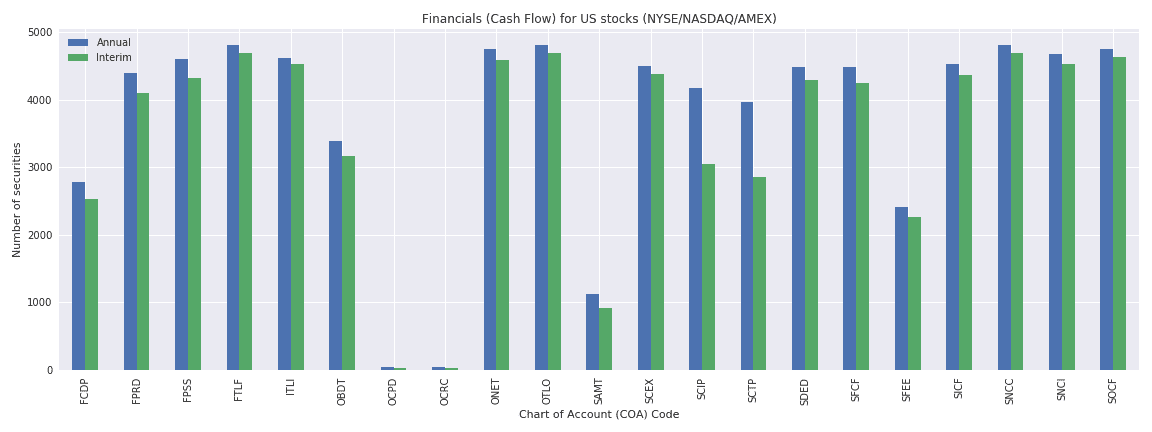

The following charts show the availability of Reuters financials for select countries and exchanges, broken down by indicator code. (Only the most common countries and exchanges are shown.)

Australia

Austria

Belgium

Canada

France

Germany

Hong Kong

India

Italy

Japan

Mexico

Netherlands

Singapore

Spain

Sweden

Switzerland

United Kingdom

United States

Listed stocks (NYSE/NASDAQ/AMEX)

OTC stocks (PINK)